In today’s fast-paced world, digital banking has become increasingly prevalent, offering unparalleled convenience and accessibility. Many individuals are considering making the switch from traditional banking to embrace the advantages of managing their finances online. This transition, however, can feel daunting for some. This article provides a comprehensive guide on how to switch from traditional banking to digital banking smoothly, ensuring a seamless and secure experience. We’ll explore the key steps involved, address common concerns, and highlight the numerous benefits of adopting digital banking solutions.

Switching to digital banking offers a range of advantages, including 24/7 account access, faster transactions, and enhanced security features. Whether you are looking to streamline your finances, gain greater control over your money, or simply experience the convenience of modern banking, understanding the process of transitioning from traditional banking is essential. This guide will equip you with the knowledge and resources necessary to navigate this change successfully and confidently embark on your digital banking journey.

Reasons to Make the Switch

Switching to digital banking offers numerous advantages. Convenience is a key factor, allowing you to manage your finances anytime, anywhere. Digital banking also offers enhanced security features, such as multi-factor authentication and real-time transaction alerts, to protect your funds.

Efficiency is another compelling reason. Transactions are processed quickly, and you can easily track your spending and budgeting. Furthermore, digital banking often comes with lower fees compared to traditional banking, helping you save money.

Steps to Transition Without Disruption

Begin gradually. Don’t feel pressured to move everything at once. Start by exploring the digital platform and using it for simple transactions like balance checks and fund transfers.

Link your existing accounts. Ensure your traditional accounts are properly linked to the digital platform for a seamless flow of information and easy access to all your finances.

Set up alerts and notifications. Take advantage of digital banking features like account balance alerts and transaction notifications to stay informed and maintain control over your finances.

Familiarize yourself with security features. Understand the platform’s security protocols, including two-factor authentication and fraud prevention measures, to ensure the safety of your funds.

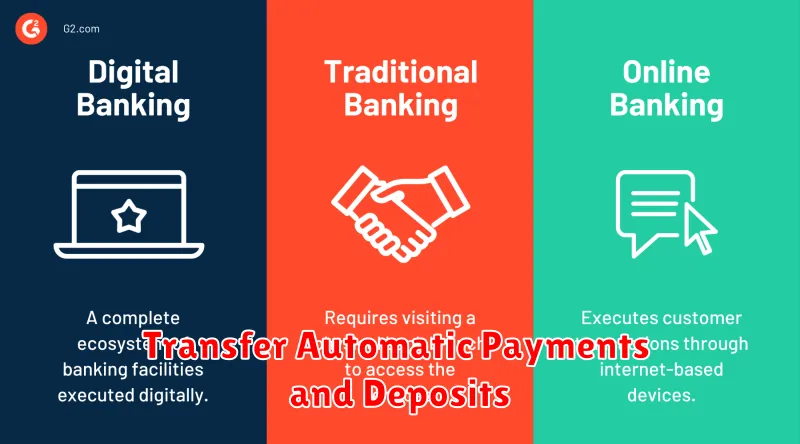

Transfer Automatic Payments and Deposits

A crucial step in transitioning to digital banking is moving your automatic payments and deposits. This includes recurring bills like utilities, subscriptions, and loan payments, as well as regular deposits such as paychecks.

Start by identifying all your current automatic transactions. Contact the respective companies or institutions (e.g., utility providers, employers) to update your banking information with your new digital account details. Verify the changes have been successfully processed by monitoring your accounts for a few payment cycles.

Inform Employers and Billers Early

Notify your employer and any billers (utilities, subscriptions, etc.) about your switch to digital banking as soon as possible. This allows them to update their records with your new account and routing numbers. This proactive approach helps prevent any disruptions in payments, such as direct deposits or automatic bill payments. Provide them with the necessary information accurately to ensure a seamless transition.

Get Familiar with App Functions

Once you’ve chosen a digital bank and set up your account, take time to explore the app’s functionalities. Navigation is key. Locate crucial features like balance checks, fund transfers, and bill pay. Understanding how to perform these essential tasks will empower you to manage your finances efficiently.

Look for additional features like mobile check deposit, budgeting tools, and spending trackers. These tools can significantly simplify your financial management. Don’t hesitate to consult the app’s help section or contact customer support for assistance navigating any unfamiliar features.

Test with a Small Balance First

Before fully committing to a digital bank, start with a small test balance. Transfer a limited amount of money into your new digital account. This allows you to experience the platform’s functionality and interface without risking significant funds.

Use this trial period to explore features such as bill pay, mobile check deposit, and money transfers. Monitor the account activity and customer service responsiveness to ensure they meet your needs.

When to Close Your Old Account

Closing your old account is the final step in transitioning to digital banking. It’s crucial to time this correctly to avoid any disruptions. Don’t close your old account immediately after opening your new one.

Maintain both accounts for a short overlap period, typically two to four weeks. This provides a buffer to ensure all automatic payments, direct deposits, and outstanding checks have cleared.

Once you’ve confirmed all transactions are processed, and your new digital account is functioning smoothly, you can then proceed to close the traditional account. Contact your old bank directly to initiate the closure process.