Understanding your bank transaction history is crucial for managing your finances effectively. Whether you’re using a mobile banking app or online banking platform, being able to decipher the information presented in your transaction history empowers you to track spending, identify potential errors, and maintain a clear picture of your financial health. This article will provide a comprehensive guide on how to understand bank transaction histories in apps, covering everything from common abbreviations and transaction types to tips for identifying unauthorized activity and maximizing the utility of your banking app’s features.

Navigating the details within your bank transaction history can sometimes feel overwhelming. From cryptic abbreviations to varying transaction types, it’s important to understand what each element signifies. This article aims to demystify your bank app transaction history, providing clear explanations and practical examples to help you confidently interpret the information presented. By the end of this guide, you’ll be equipped to effectively analyze your transaction history, identify trends in your spending habits, and proactively manage your finances with greater precision using your banking app.

Reading and Interpreting Your Statement

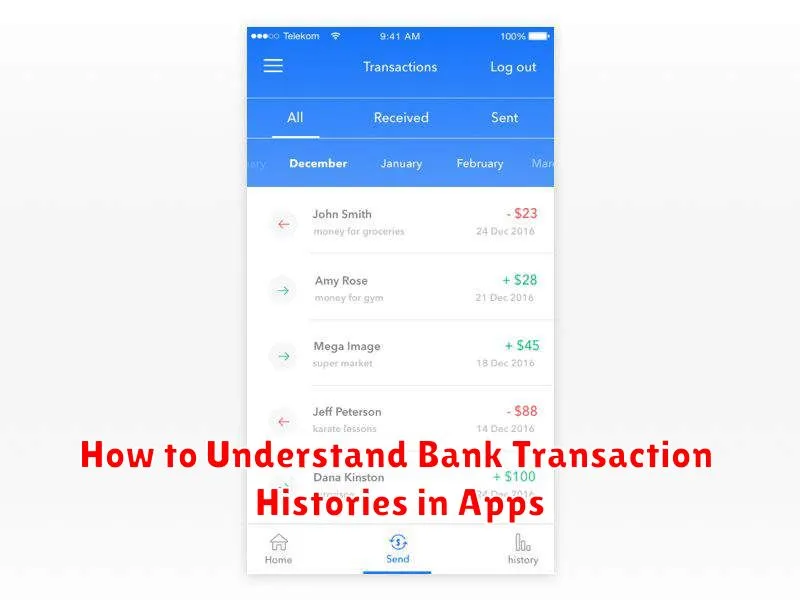

Your bank statement provides a detailed record of your account activity. Each entry typically includes the transaction date, a description of the transaction, and the amount. Positive amounts represent credits (money coming in), while negative amounts indicate debits (money going out).

Carefully review each transaction to ensure its accuracy. Look for unfamiliar transactions and contact your bank immediately if you spot anything suspicious. Understanding your statement is crucial for managing your finances effectively.

Common Abbreviations and Terms

Understanding your bank transaction history is easier with a grasp of common abbreviations and terms. CR typically indicates a credit, meaning funds added to your account. DR signifies a debit, representing funds deducted. ATM refers to Automated Teller Machine transactions. POS stands for Point of Sale, indicating purchases made using your debit or credit card. ACH denotes Automated Clearing House, often used for direct deposits and electronic payments.

Other common terms include balance, which reflects the amount of money in your account, and pending transactions, which are transactions that have not yet been fully processed.

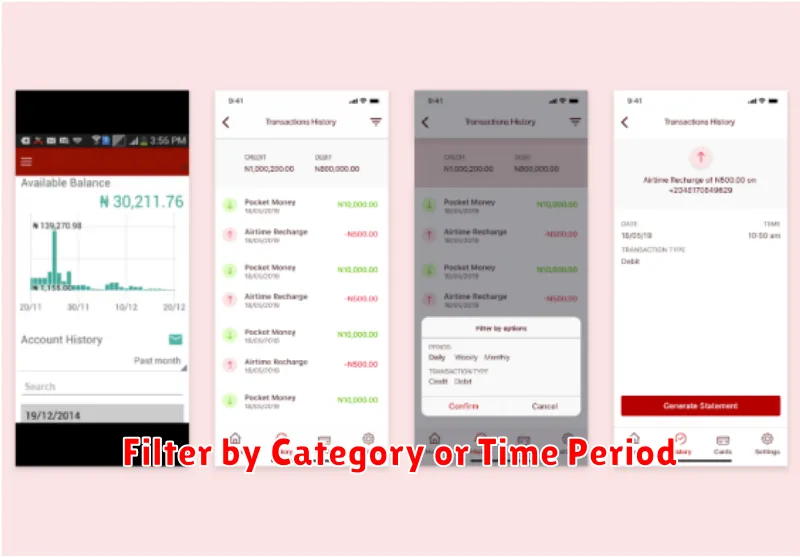

Filter by Category or Time Period

Most banking apps offer filtering options to help you quickly find specific transactions. Category filters allow you to view transactions related to groceries, transportation, or entertainment, for example. This helps analyze spending habits within specific areas.

Time period filters let you narrow down transactions to specific dates or ranges, such as the last week, month, or a custom period. This is useful for tracking expenses within a particular timeframe, such as when preparing for taxes or creating a budget.

Track Subscriptions and Auto-Payments

Subscription services and automatic payments can easily become overlooked expenses. Your banking app’s transaction history provides a crucial tool for monitoring these recurring charges.

Regularly review your transactions to identify subscriptions like streaming services, gym memberships, or software licenses. Look for consistent debits from the same vendor, often with similar amounts and frequencies. This allows you to stay aware of active subscriptions and detect any unauthorized charges.

Spotting Errors or Unauthorized Charges

Regularly reviewing your transaction history is crucial for identifying potential errors or unauthorized charges. Look for transactions you don’t recognize, including incorrect amounts, duplicate postings, or charges from unfamiliar merchants.

Pay close attention to small, recurring charges that might be easily overlooked. These can sometimes indicate a subscription you forgot about or, worse, a fraudulent activity. If anything seems suspicious, immediately contact your bank to report the issue.

Downloading and Exporting Reports

Most banking apps allow you to download and export your transaction history for record-keeping and analysis. Typically, you can choose a specific date range for the report.

Common export formats include CSV, PDF, and QFX. The availability of these formats may vary depending on your bank and the app’s features. Check the app’s settings or help section for detailed instructions on downloading and exporting your transaction data.

Using Transaction Insights to Budget Better

Transaction insights transform raw banking data into actionable budgeting tools. Analyzing spending patterns reveals areas for potential savings.

Apps categorize transactions, allowing you to quickly see where your money goes. This clarity empowers you to make informed decisions about spending habits.

By identifying recurring expenses and understanding spending trends, you can develop a more realistic and effective budget.