In today’s rapidly evolving financial landscape, digital banks are leveraging the power of Artificial Intelligence (AI) to revolutionize the user experience. This innovative approach is transforming how customers interact with their finances, offering personalized services, enhanced security, and streamlined processes. From AI-powered chatbots providing instant customer support to sophisticated algorithms detecting fraudulent activities, the integration of AI is reshaping the very core of digital banking. Understanding how these technologies are being deployed is crucial for both financial institutions and consumers alike. This article explores the multifaceted ways digital banks are utilizing AI to significantly improve the user experience and drive customer satisfaction.

The benefits of AI in digital banking extend far beyond simple automation. By analyzing vast amounts of data, AI algorithms can provide personalized financial advice, tailored product recommendations, and proactive fraud prevention. This level of personalization and security is unprecedented in traditional banking and represents a significant leap forward in the user experience. Furthermore, AI is enabling digital banks to offer 24/7 customer support, faster transaction processing, and more efficient account management. Join us as we delve into the specific applications of AI within digital banking, exploring how this transformative technology is shaping the future of finance and creating a superior user experience for customers worldwide.

Introduction to AI in Banking

Artificial intelligence (AI) is rapidly transforming the banking industry, enabling digital banks to offer personalized and efficient services. AI empowers these banks to analyze vast amounts of data, identify patterns, and automate tasks, ultimately enhancing the user experience. From fraud detection and risk assessment to personalized financial advice and customer support, AI plays a crucial role in shaping the future of banking.

Key applications of AI in digital banking include chatbots for 24/7 customer service, algorithmic loan approvals, and personalized financial management tools. These innovations contribute to a more seamless, convenient, and secure banking experience for customers.

Chatbots and Virtual Assistants

Digital banks leverage AI-powered chatbots and virtual assistants to provide 24/7 customer support. These intelligent tools handle routine inquiries, troubleshoot simple issues, and guide users through various banking processes. This frees up human agents to focus on more complex requests.

Chatbots offer personalized support by analyzing user data and past interactions. They can proactively offer assistance and tailored product recommendations, enhancing the overall customer experience.

Personalized Financial Insights

AI empowers digital banks to provide personalized financial insights. By analyzing user spending patterns, AI can offer budgeting advice, flag potential overspending, and even suggest investment opportunities tailored to individual financial goals. This level of personalized guidance helps users make informed financial decisions and achieve greater financial wellness.

For example, AI might analyze recurring expenses and suggest ways to reduce monthly bills or identify areas where users could save for a specific goal, like a down payment on a house. This proactive approach to financial management distinguishes digital banks from traditional institutions.

Fraud Detection with AI Algorithms

AI algorithms play a crucial role in enhancing security within digital banking. These algorithms analyze massive datasets of transaction data to identify patterns and anomalies indicative of fraudulent activity.

Real-time transaction monitoring allows for immediate detection of suspicious transactions, which can then be flagged for review or blocked entirely. This proactive approach minimizes financial losses for both the bank and its customers.

Machine learning models adapt and evolve over time, improving their accuracy in identifying new and emerging fraud tactics. This adaptability is vital in the constantly changing landscape of online security threats.

Predictive Budgeting and Spending Analysis

AI-powered predictive budgeting tools analyze user spending patterns to forecast future expenses. This allows digital banks to provide personalized budgeting advice and alerts to customers, helping them manage their finances more effectively.

These tools can predict potential cash flow issues and suggest adjustments to spending habits. Spending analysis features categorize transactions, providing users with a clear overview of where their money is going. This facilitates better financial planning and control.

User Behavior Analytics for Better Services

User Behavior Analytics (UBA) plays a crucial role in enhancing digital banking services. By analyzing user interactions within the banking platform, AI can identify patterns and predict future behavior. This data-driven approach empowers banks to personalize the user experience.

Personalized recommendations for financial products, tailored alerts for potentially fraudulent activity, and proactive customer support are just a few examples of how UBA improves the overall user experience. Analyzing typical login times, transaction amounts, and other behaviors allows the bank to offer customized solutions and predict customer needs.

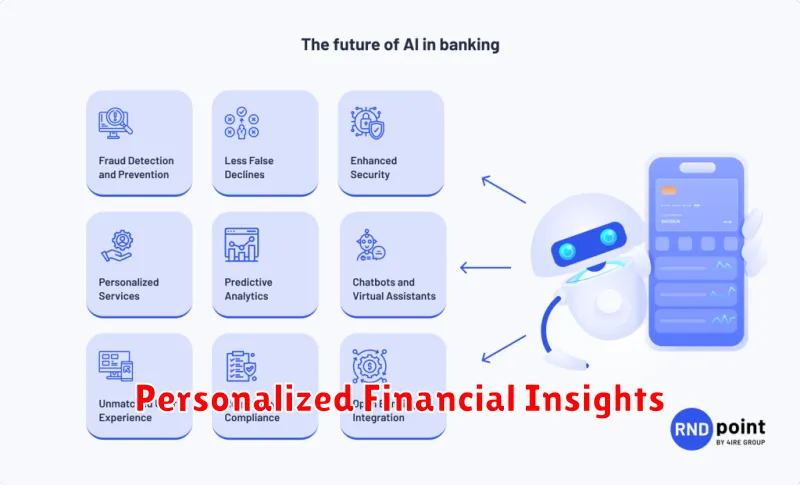

What the Future Holds for AI in Banking

The future of AI in banking promises even more personalized and efficient services. AI-powered hyper-personalization will anticipate customer needs, offering tailored financial advice and product recommendations.

Enhanced fraud detection capabilities will leverage advanced algorithms to identify and prevent increasingly sophisticated cyber threats. Streamlined lending processes through AI-driven credit scoring and risk assessment will make loan approvals faster and more accessible.

Ultimately, AI is poised to transform banking into a more proactive and customer-centric industry.