In today’s hyper-connected world, the convenience of digital banking is undeniable. Managing finances from anywhere, at any time, has become the norm. However, this constant accessibility can also lead to digital banking burnout, a state of mental and emotional exhaustion stemming from the overwhelming nature of managing finances online. Are you constantly checking your balance, stressed about budgeting apps, or feeling overwhelmed by the sheer volume of financial information at your fingertips? This article will provide practical strategies to help you navigate the digital financial landscape and avoid digital banking burnout, empowering you to reclaim control over your financial well-being and cultivate a healthier relationship with your money.

Learning how to avoid digital banking burnout is crucial for maintaining a healthy relationship with your finances. This article will explore the common signs of digital banking fatigue, such as obsessive checking of accounts, anxiety related to financial apps, and feeling overwhelmed by the constant influx of financial information. We’ll delve into the underlying causes of this phenomenon and provide actionable steps to mitigate its effects. By understanding the potential pitfalls of digital banking and implementing the strategies outlined in this article, you can harness the power of online banking while safeguarding your mental and emotional well-being. Reclaim your peace of mind and discover how to achieve a more balanced approach to digital finance.

What Is Digital Banking Burnout?

Digital banking burnout is a state of mental and emotional exhaustion specifically related to managing your finances online. It’s characterized by feelings of overwhelm, frustration, and apathy towards digital banking platforms and processes.

This can manifest as avoiding logging into accounts, delaying payments, or experiencing anxiety when dealing with financial tasks online. The constant influx of notifications, security concerns, and the pressure to stay on top of finances in the digital age contribute to this growing phenomenon.

Signs You’re Overwhelmed by Notifications

Constant notifications can lead to digital banking burnout. Recognizing the signs is the first step to regaining control.

Anxiety or dread when hearing notification sounds is a key indicator. Do you find yourself constantly checking your phone, even when there’s no alert? This compulsive checking behavior points to notification overload.

Ignoring important notifications is another sign. When overwhelmed, you may start dismissing all notifications, leading to missed crucial updates about your finances.

Reducing Alert Fatigue and Screen Time

Constant notifications from banking apps can contribute significantly to digital burnout. Minimize unnecessary alerts by customizing notification settings. Focus on essential alerts like low balance warnings or suspicious activity.

Schedule designated times for checking your accounts to avoid constantly being drawn to the app. This helps establish healthy boundaries and reduces overall screen time. Consolidating banking tasks into specific periods also improves efficiency.

Use Weekly Summaries Instead of Instant Alerts

Constant transaction notifications contribute significantly to digital banking burnout. The incessant buzzing and pinging creates a sense of urgency and pressure, even for routine transactions. Switching to weekly summaries provides a digestible overview of your account activity without the constant interruptions.

This allows you to review your finances strategically, identifying spending patterns and potential issues on a less stressful schedule. You regain control over your attention and minimize the anxiety associated with constant monitoring.

Balance Automation with Manual Checks

Automation plays a vital role in streamlining digital banking tasks. However, relying solely on automated processes can be risky. Regular manual checks are essential to ensure accuracy and identify potential issues that automated systems might miss.

Schedule periodic reviews of your transactions and account balances. This helps catch errors early and maintain a clear overview of your finances. Combine the efficiency of automation with the security of manual oversight for a balanced and reliable approach to digital banking.

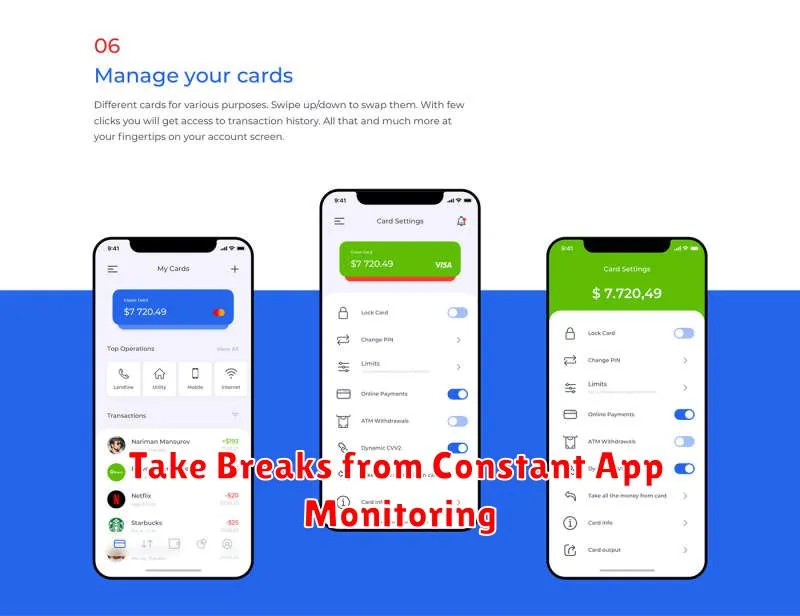

Take Breaks from Constant App Monitoring

Constantly checking your banking app can contribute to digital burnout. Scheduled breaks are crucial. Establish specific times during the day to review your finances. This prevents obsessive monitoring and reduces anxiety related to money management.

Consider using the “Do Not Disturb” feature on your phone or temporarily disabling app notifications. This creates necessary distance and allows you to focus on other activities.

When to Seek Professional Financial Advice

While digital banking offers convenience, certain situations warrant professional financial guidance. Seek advice when facing major life changes such as marriage, divorce, or inheritance. A financial advisor can also help with complex financial decisions like retirement planning or investment management.

If you feel overwhelmed by managing your finances or experience consistent financial stress, consulting a professional can provide clarity and support. Finally, consider seeking advice if your financial situation becomes significantly more complex, perhaps due to a new business venture or substantial increase in assets.