In today’s rapidly evolving financial landscape, the concept of a cashless society is becoming increasingly prevalent. Digital banking offers a compelling pathway to embrace a fully cashless lifestyle, presenting a multitude of benefits for both consumers and businesses. This article will delve into the advantages of transitioning to a completely cashless existence through the utilization of digital banking platforms, exploring the convenience, security, and efficiency they offer.

From streamlined transactions and enhanced financial management to reduced risks and increased economic transparency, the benefits of going fully cashless with digital banking are numerous and impactful. By embracing digital banking solutions, individuals and businesses can unlock a new era of financial convenience and control. This article will examine the key benefits of transitioning to a cashless society through digital banking, highlighting its potential to revolutionize how we interact with money in the modern world.

What Does It Mean to Go Cashless?

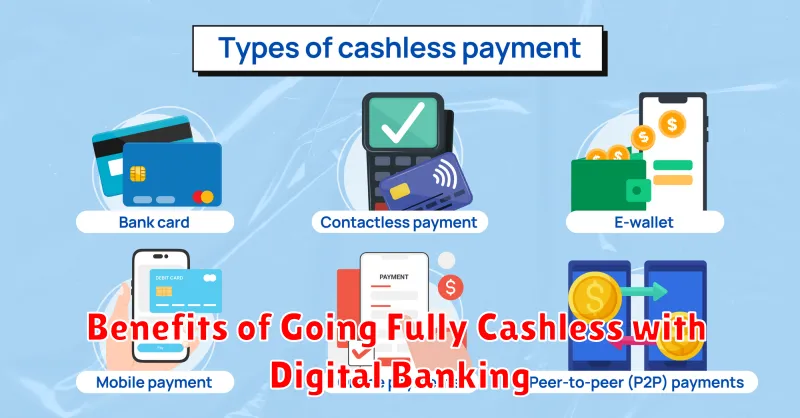

Going cashless means eliminating the use of physical currency like banknotes and coins for transactions. Instead, all payments are handled electronically, utilizing methods such as credit cards, debit cards, mobile wallets, and online transfers.

A cashless society relies heavily on digital infrastructure and secure networks to process these transactions. It signifies a shift towards a more digitalized financial system where money exists primarily as data within financial institutions.

Digital Wallets and Mobile Payment Options

Digital wallets represent a cornerstone of the cashless experience. These applications securely store your credit and debit card information, allowing for contactless payments via near-field communication (NFC) technology.

Popular digital wallet options include Apple Pay, Google Pay, and Samsung Pay. These platforms provide an added layer of security, often using tokenization to protect sensitive card details during transactions.

Mobile payment options extend beyond digital wallets, encompassing peer-to-peer (P2P) payment apps. These apps allow for quick and convenient money transfers between individuals, facilitating seamless transactions without physical cash.

Tracking Spending More Easily

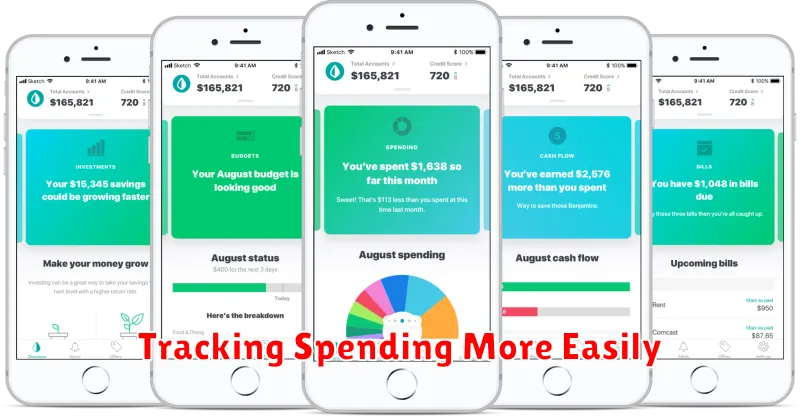

One of the most significant advantages of a cashless digital banking experience is the effortless tracking of your expenditures. Every transaction is automatically recorded within the app, eliminating the need for manual logging or saving receipts.

This provides a clear and comprehensive overview of your spending habits. Digital banking apps often categorize transactions, making it simple to see where your money is going. This feature is invaluable for budgeting and identifying areas where you might be overspending.

Reduced Risk of Theft or Loss

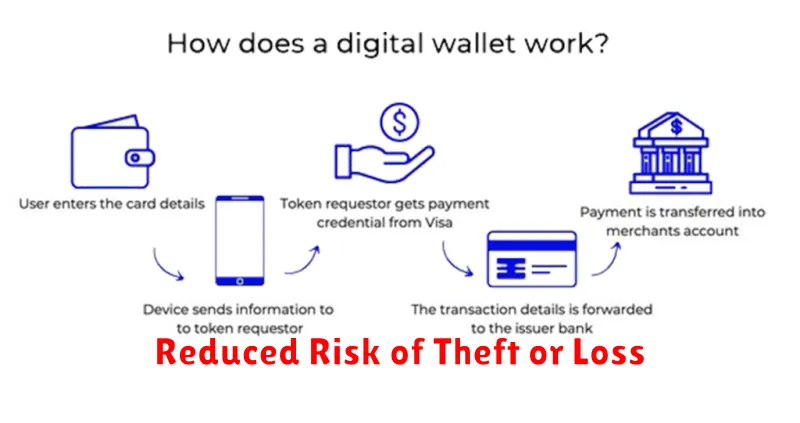

Going cashless significantly reduces the risk of physical theft. Eliminating the need to carry large amounts of cash minimizes your vulnerability to pickpockets and robberies. Similarly, the loss of physical cash, whether misplaced or accidentally destroyed, is no longer a concern.

With digital transactions, your money is securely held within your account, protected by encryption and other security measures. This enhanced security provides peace of mind knowing your funds are safe even if your physical devices are compromised.

Easier Online and International Transactions

Digital banking facilitates seamless online transactions. Paying bills, shopping online, and transferring funds become significantly more efficient. No more writing checks or visiting physical branches.

International transactions also become simpler and often less expensive. Digital banking platforms frequently offer competitive exchange rates and lower transaction fees compared to traditional banks.

How to Start Living Cash-Free

Transitioning to a cash-free lifestyle requires planning and adopting new habits. Begin by embracing digital banking tools. Set up mobile banking and familiarize yourself with its features, including peer-to-peer payment apps. Link your debit and credit cards to these apps for seamless transactions.

Identify businesses that accept digital payments. Most establishments now offer card or mobile payment options. Start small by using digital methods for everyday purchases like coffee or groceries. Gradually increase cashless transactions as you become more comfortable.

Ensure you have reliable access to charged devices and stable internet connectivity to avoid disruptions. Carry a portable charger for your phone to prevent unexpected battery drain.

Potential Downsides to Be Aware Of

While a cashless society offers numerous advantages, some potential downsides need consideration. Security breaches pose a significant risk, as digital systems are vulnerable to hacking and fraud. A reliance on technology can create issues during system outages or for individuals lacking access to devices or reliable internet connectivity.

Privacy concerns also arise, as digital transactions generate data that can be tracked and potentially misused. Finally, the exclusion of certain demographics, particularly the unbanked or technologically illiterate, can exacerbate existing inequalities.