In today’s fast-paced world, managing finances effectively is more critical than ever. Budgeting is a cornerstone of financial stability, enabling individuals to track their spending, save for the future, and achieve their financial goals. However, traditional budgeting methods can be cumbersome and time-consuming. Fortunately, the rise of mobile banking apps has revolutionized the way we manage our money, making budgeting easier and more accessible than ever before. These powerful tools put the control of your finances right in the palm of your hand, offering a convenient and efficient way to stay on top of your spending and work towards a more secure financial future. Learn how leveraging the capabilities of mobile banking apps can simplify the budgeting process and empower you to take control of your finances.

This article will explore the various ways mobile banking apps simplify budgeting. We’ll delve into features such as real-time spending tracking, automated budget alerts, and expense categorization, demonstrating how these tools can streamline the budgeting process. Discover how mobile banking apps can empower you to make informed financial decisions, identify areas for potential savings, and ultimately achieve your financial aspirations with less effort. Whether you’re a seasoned budgeter or just starting out, harnessing the power of mobile banking apps can make a significant difference in your journey towards financial well-being. Join us as we explore the benefits and uncover why budgeting is easier with mobile banking apps.

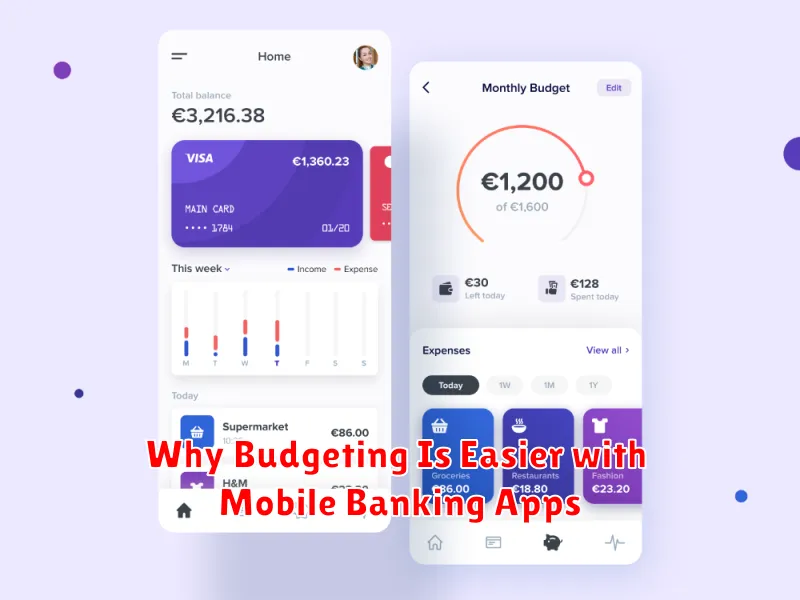

Budget Tools Built into Banking Apps

Many banking apps now include built-in budgeting tools, adding another layer of convenience for managing finances. These tools typically offer features such as spending trackers, budget creators, and financial goal setters. They automatically categorize transactions, providing a clear picture of where your money is going.

Some apps even offer personalized alerts for exceeding budget limits or upcoming bill payments. This integration of budgeting directly within your banking app streamlines the process, eliminating the need for separate budgeting software.

Setting Up Spending Alerts

Staying within budget requires vigilance. Mobile banking apps offer invaluable tools like spending alerts to help you monitor your finances proactively. These alerts notify you in real-time about your account activity, keeping you informed of your spending habits.

Most apps allow customization. You can set alerts for various scenarios, such as low balance warnings, deposit notifications, or when a transaction exceeds a specified amount. This allows for personalized control over your finances and helps prevent overspending.

Setting up these alerts is usually straightforward. Navigate to the notifications or alerts section within your app and define your preferred parameters. These real-time updates contribute significantly to effective budget management.

Real-Time Balance and Expense Tracking

Mobile banking apps provide instant access to your account balance. This real-time view eliminates guesswork and promotes better financial awareness. You can see exactly how much money is available, helping you avoid overdrafts and make informed spending decisions.

Beyond balance checks, these apps often categorize your spending automatically. This automated expense tracking allows you to quickly identify spending patterns and areas where you might be overspending. Some apps even provide budgeting tools that utilize this expense data to create personalized budgets and spending alerts.

Customizable Goals and Progress Bars

Many mobile banking apps offer customizable goal-setting features. You can establish specific savings targets, such as a down payment on a house or a vacation fund. The app allows you to name the goal, set the target amount, and establish a timeline.

Progress bars visually represent your progress toward each goal, providing motivation and a clear picture of your financial journey. These tools help make saving more engaging and less abstract.

Linking to External Finance Apps

Many mobile banking apps offer the ability to link to external finance apps. This can be a powerful tool for managing your finances, as it allows you to see all of your financial information in one place.

By linking your accounts, you can get a holistic view of your spending and saving habits. This can make it easier to identify areas where you can improve your budgeting. For example, if you see that you are spending a lot of money on eating out, you may want to consider cooking at home more often.

Some apps offer automatic categorization of transactions, making tracking expenses even simpler. This feature automatically assigns categories such as “Groceries,” “Utilities,” or “Entertainment” to your transactions, reducing manual effort and enhancing budget tracking accuracy.

Weekly and Monthly Reports for Better Planning

Many mobile banking apps offer automated reporting features. These reports provide a clear overview of your spending habits over different time periods.

Weekly reports can help you track your spending pulse and make quick adjustments to stay within budget. Monthly reports offer a broader perspective, enabling you to identify larger spending trends and refine your budget for the following month.

These reports are often customizable, allowing you to focus on specific spending categories. This detailed analysis empowers you to make more informed financial decisions and achieve your financial goals.

Encouraging Healthy Financial Habits

Mobile banking apps are instrumental in fostering positive financial habits. Real-time access to account balances promotes increased awareness of spending patterns. This awareness is crucial for effective budgeting and helps individuals make informed financial decisions.

Furthermore, many apps offer personalized budgeting tools and expense trackers. These features simplify the process of setting financial goals and monitoring progress. By providing readily available insights into income and expenditure, mobile banking empowers users to take control of their finances and cultivate responsible financial habits.