In today’s fast-paced digital world, managing finances effectively is more critical than ever. Setting smart financial goals is the cornerstone of financial success, and leveraging the power of digital banking apps can significantly streamline this process. This article will explore how you can harness the features of these apps to define, track, and achieve your financial aspirations, whether you’re saving for a down payment, paying off debt, or building a robust investment portfolio. Learn how to set SMART goals — Specific, Measurable, Achievable, Relevant, and Time-Bound — with the assistance of digital banking tools.

Digital banking apps provide a convenient and powerful platform for taking control of your finances. From budgeting and expense tracking to automated savings and investment management, these apps offer a wealth of features to help you achieve your financial goals. Discover how to effectively use these tools to set smart financial goals that are tailored to your individual needs and circumstances. This guide will provide practical advice and actionable steps to optimize your use of digital banking apps for enhanced financial well-being and long-term success.

The Importance of Goal-Based Saving

Goal-based saving provides a clear purpose for your financial efforts. By defining specific objectives, such as a down payment on a house or a dream vacation, you create a strong motivational factor.

This targeted approach encourages consistent saving habits and helps you prioritize expenses. Knowing exactly what you’re saving for makes it easier to resist impulsive purchases and stay focused on your long-term financial well-being.

Ultimately, goal-based saving fosters a sense of control and accomplishment as you make tangible progress towards your desired outcomes.

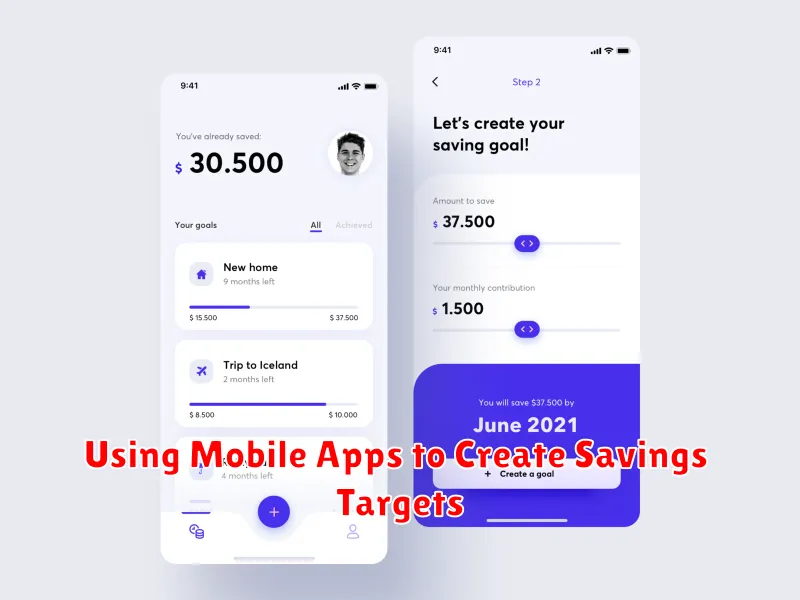

Using Mobile Apps to Create Savings Targets

Digital banking apps offer convenient tools for establishing savings targets. Define a specific goal, such as a down payment for a house or a vacation. Then, set a realistic timeframe for achieving it.

Many apps allow you to create separate savings accounts dedicated to individual goals. This helps you track your progress and avoid dipping into funds allocated for other purposes.

Utilize the app’s automated savings features. Set up recurring transfers or round-up purchases to effortlessly contribute to your savings. Regularly monitor your progress and adjust your savings plan as needed.

Automating Deposits and Notifications

Digital banking apps offer powerful tools to automate your savings. Automated deposits make saving effortless. Set up recurring transfers from your checking account to your savings account on a schedule that works for you—weekly, bi-weekly, or monthly. Even small, regular contributions add up significantly over time.

Real-time notifications keep you informed about your account activity. Set up alerts for low balances, deposits, and withdrawals to stay on top of your finances and avoid overdraft fees. These features provide valuable insights into your spending habits and help you maintain control over your money.

Visualizing Progress and Milestones

Digital banking apps often provide tools to visualize your financial journey. Tracking your progress towards a goal can be highly motivating.

Many apps offer features like progress bars, charts, or graphs. These visual aids clearly demonstrate how far you’ve come and how much further you need to go. This can reinforce positive financial behavior and provide a sense of accomplishment.

Some apps also allow you to set milestones within a larger goal. Breaking down a large goal into smaller, manageable steps can make the overall objective seem less daunting.

Choosing Short-Term vs. Long-Term Goals

A key aspect of financial planning involves differentiating between short-term and long-term goals. Short-term goals are typically achievable within a year, such as building an emergency fund or paying off a small debt. Digital banking apps can help track progress towards these goals by providing budgeting tools and spending analysis.

Long-term goals, on the other hand, require more time and planning, spanning several years or even decades. Examples include saving for retirement, purchasing a home, or funding higher education. Digital banking apps can facilitate long-term saving through automated recurring transfers and investment tracking features.

Avoiding Impulse Spending with Alerts

Digital banking apps offer a powerful tool against impulse spending: real-time alerts. These notifications can be customized to inform you of account balances, transactions exceeding specific amounts, or upcoming bill payments.

By setting up low-balance alerts, you gain a constant awareness of your spending habits and available funds. This prevents overdraft fees and encourages mindful purchasing decisions. Transaction alerts offer immediate oversight, allowing you to quickly identify potentially fraudulent activity or simply reflect on recent expenditures.

Tracking and Adjusting Goals Over Time

Regularly monitoring your progress is crucial for successful financial goal achievement. Digital banking apps offer tools to track spending, monitor budgets, and visualize progress towards your goals. This allows for timely adjustments.

Life changes, and your financial goals may need to adapt. Don’t be afraid to re-evaluate and adjust your goals or timelines as needed. Increased income, unexpected expenses, or shifts in priorities may require modifications to your plan.