In today’s rapidly evolving digital landscape, e-KYC (electronic Know Your Customer) has become an indispensable component of digital banking. Understanding e-KYC is crucial for both financial institutions and customers. This article will delve into the intricacies of e-KYC, exploring its definition, processes, benefits, and the crucial role it plays in ensuring secure and compliant digital banking operations. From streamlining customer onboarding to combating financial crime, the impact of e-KYC is far-reaching. We will examine how e-KYC empowers digital banking to provide a seamless and secure customer experience while adhering to stringent regulatory requirements. This understanding is essential for navigating the modern financial world.

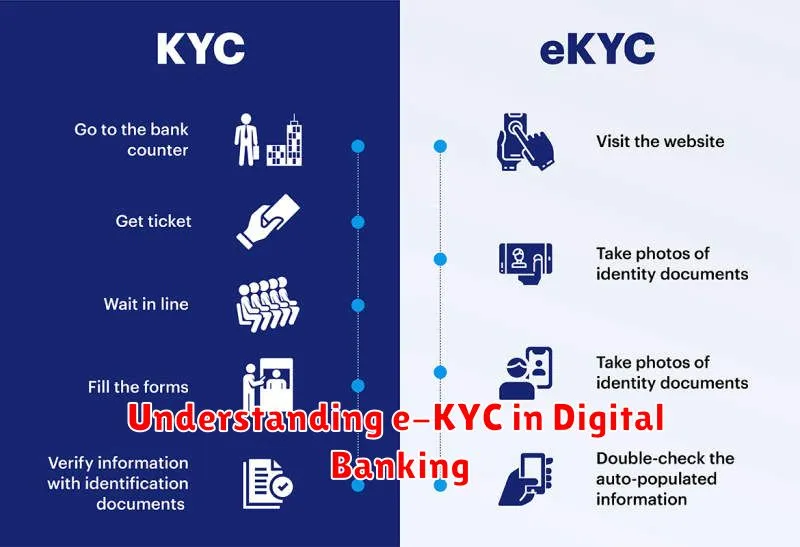

E-KYC revolutionizes traditional KYC procedures by leveraging technology to verify customer identities digitally. This shift toward digital identification has profound implications for digital banking, impacting everything from account opening to ongoing transaction monitoring. By eliminating the need for physical paperwork and in-person visits, e-KYC significantly enhances the efficiency and accessibility of digital banking services. This article will explore the various methods employed in e-KYC, such as biometric authentication, document verification, and digital identity platforms, highlighting their role in ensuring robust security and regulatory compliance in the digital banking ecosystem. We will analyze the advantages and challenges associated with e-KYC implementation, providing a comprehensive understanding of this transformative technology within the context of modern digital banking.

What Is e-KYC and Why It Matters

e-KYC, or electronic Know Your Customer, is the digital process of verifying a customer’s identity. It replaces traditional, paper-based methods with online verification, streamlining customer onboarding.

This digital transformation is crucial for several reasons. e-KYC significantly reduces the time and costs associated with manual KYC procedures. It also enhances security by mitigating fraud risks through robust authentication methods like biometric verification and digital document analysis.

Furthermore, e-KYC provides a more convenient and accessible customer experience, allowing for remote onboarding and 24/7 availability. This is especially important in today’s increasingly digital world.

How e-KYC Works in Practice

The e-KYC process typically begins with a customer initiating an account opening or a transaction that requires identity verification. The customer then submits their personal information, often through an online form. This might include their name, address, date of birth, and identification number.

Next, the e-KYC system performs identity verification. This can involve several methods like facial recognition by comparing a selfie to an uploaded ID document, Optical Character Recognition (OCR) to extract data from the ID, and document verification to check its authenticity against a database.

Finally, the system performs risk assessment based on the information gathered and relevant regulations. Upon successful verification and risk assessment, the customer’s identity is confirmed, allowing them to proceed with the desired service.

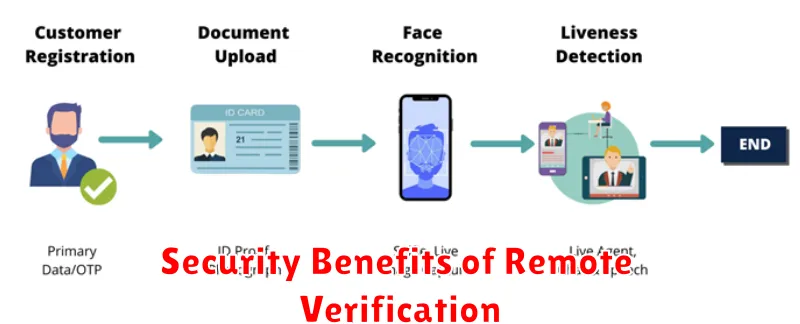

Security Benefits of Remote Verification

Remote verification significantly enhances security in digital banking by mitigating risks associated with traditional, in-person KYC processes. Fraud reduction is a key benefit, as remote verification employs sophisticated methods like facial recognition and liveness detection to combat identity theft. This digital approach also strengthens data security by minimizing physical document handling and employing secure data storage and transmission protocols.

Furthermore, remote verification offers improved audit trails. Every step of the verification process is digitally recorded, providing a comprehensive and readily accessible audit history for compliance and fraud investigation purposes.

Challenges and Limitations to Know

While e-KYC offers numerous advantages, it also faces several challenges. Data security and privacy are paramount concerns. Protecting sensitive customer information from breaches and misuse is crucial.

Regulatory compliance can be complex, varying across jurisdictions. Staying updated with evolving regulations and ensuring adherence is essential for successful e-KYC implementation. Technological limitations, such as internet access disparities, can hinder accessibility for some customer segments.

Fraud and identity theft remain significant threats. Sophisticated methods are employed to bypass security measures, requiring continuous development and adaptation of e-KYC systems.

Where e-KYC Is Commonly Used

E-KYC is rapidly becoming the standard for identity verification across various industries, streamlining processes and enhancing security. Its most prevalent application is within the financial services sector.

Digital banking heavily relies on e-KYC for account opening, loan applications, and other transactions. Beyond banking, e-KYC is utilized in investment platforms for onboarding investors and ensuring regulatory compliance. The telecommunications industry also employs e-KYC for SIM card registration and mobile money services. Its use extends further into cryptocurrency exchanges and other fintech platforms for user verification and anti-money laundering (AML) compliance.

Tips to Complete e-KYC Without Errors

Accurate completion of e-KYC is crucial for accessing digital banking services. Follow these tips to ensure a seamless process.

Double-check all entered information. Ensure your name, address, and identification details match your official documents precisely. Avoid using nicknames or abbreviations.

Provide clear and legible documentation. Scanned documents or photographs should be well-lit and in focus to prevent processing delays.

Follow instructions carefully. Each institution may have specific requirements. Review the guidelines thoroughly before beginning the process.

Future Trends in e-KYC and Identity Tech

The future of e-KYC is trending towards decentralized identity and self-sovereign identity. This empowers users with greater control over their personal data.

Biometric authentication methods like facial recognition and behavioral biometrics are gaining traction, offering enhanced security and seamless user experiences.

Artificial intelligence (AI) and machine learning (ML) are playing a crucial role in automating KYC processes, detecting fraud, and improving risk assessment.