In today’s fast-paced world, digital banking has revolutionized how we manage our finances. It offers a convenient, secure, and efficient way to access and control your accounts, make transactions, and utilize a wide array of financial services, all from the comfort of your own home or on the go via your mobile device or computer. This comprehensive guide explores the intricacies of digital banking, demystifying its workings and highlighting its numerous benefits for individuals and businesses alike. Understanding what digital banking is and how it works is crucial in navigating the modern financial landscape.

Digital banking, also known as online banking or internet banking, encompasses a broad spectrum of financial activities conducted electronically. From checking your account balance and transferring funds to paying bills and applying for loans, digital banking platforms provide a centralized hub for all your financial needs. This article delves into the core functionalities of digital banking, explaining how it works from a user perspective and outlining the technologies that power this transformative approach to financial management. Discover the key features and advantages of digital banking to determine if it’s the right solution for you.

The Evolution from Traditional to Digital Banking

Traditional banking relied heavily on physical branches and face-to-face interactions. Customers had to visit a branch to deposit checks, withdraw cash, or apply for loans. This model limited access and convenience, especially outside of business hours.

Digital banking emerged as a solution to these limitations. Leveraging technology, digital banking allows customers to access financial services anytime, anywhere, through internet-connected devices. This shift has significantly transformed the banking landscape, offering enhanced convenience and accessibility.

How Digital Banks Operate Without Physical Branches

Digital banks leverage technology to replace traditional brick-and-mortar infrastructure. Online platforms and mobile applications serve as the primary customer interface for account management, transactions, and customer support.

Automated processes handle many tasks, reducing operational costs. Advanced security measures, including encryption and multi-factor authentication, protect customer data and funds. For services requiring physical presence, like cash deposits or withdrawals, digital banks partner with established networks or offer alternative solutions.

Key Features of Digital Banking Platforms

Account Management: View balances, transaction history, and manage account settings anytime, anywhere.

Money Transfers: Send and receive money domestically and internationally, often with lower fees than traditional banks.

Bill Payments: Schedule and pay bills electronically, eliminating the need for paper checks and postage.

Mobile Check Deposit: Deposit checks using your smartphone’s camera, saving a trip to the bank or ATM.

Customer Support: Access customer support through various channels like chat, email, or phone.

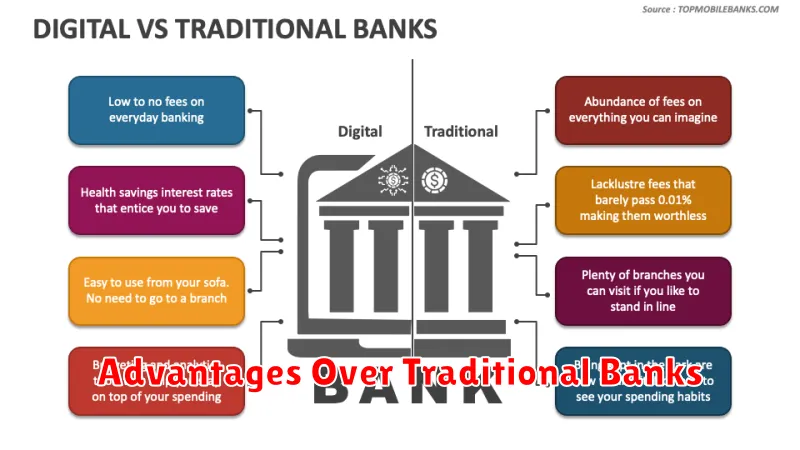

Advantages Over Traditional Banks

Digital banking offers several key advantages over traditional banking. Convenience is paramount, with 24/7 account access and the ability to conduct transactions from anywhere. This eliminates the need for physical branch visits and expands banking availability beyond traditional operating hours.

Lower fees are another significant benefit. Digital banks often have lower overhead costs, allowing them to offer reduced or even eliminated monthly maintenance fees, overdraft charges, and other common banking fees. Higher interest rates on savings accounts are also common due to these reduced operational expenses.

Innovative features such as budgeting tools, spending trackers, and real-time transaction notifications are frequently integrated into digital banking platforms, providing users with greater control and insight into their finances.

Security Measures in Digital Transactions

Security is paramount in digital banking. Several measures protect your transactions. Multi-factor authentication adds layers of security beyond passwords. Encryption scrambles data, making it unreadable to unauthorized parties. Fraud detection systems monitor for suspicious activity and alert you to potential threats.

Financial institutions also employ secure servers and firewalls to protect their systems from external attacks. Regularly updating your software and using strong, unique passwords are crucial for individual security.

Accessibility and Inclusion Through Mobile Banking

Mobile banking significantly expands financial inclusion by providing access to services for individuals previously excluded. This is particularly impactful for those in underserved communities or those with mobility limitations who may struggle to reach traditional bank branches.

The simplified interfaces and personalized features of mobile banking apps improve accessibility for users with disabilities. Features like voice control, larger text options, and screen readers empower users to manage their finances independently.

The Future of Banking in a Digital World

The future of banking is undeniably digital. Innovation continues to transform how we interact with financial institutions. We can expect to see increased personalization, with AI-powered services offering tailored financial advice and product recommendations.

Blockchain technology may revolutionize security and transparency in transactions. Furthermore, the rise of open banking will likely give customers more control over their financial data, enabling them to connect with third-party providers for innovative financial solutions. Biometric authentication will further enhance security and streamline access to banking services.

Traditional banking branches will continue to evolve, focusing on relationship management and complex financial needs, while digital channels handle everyday transactions.